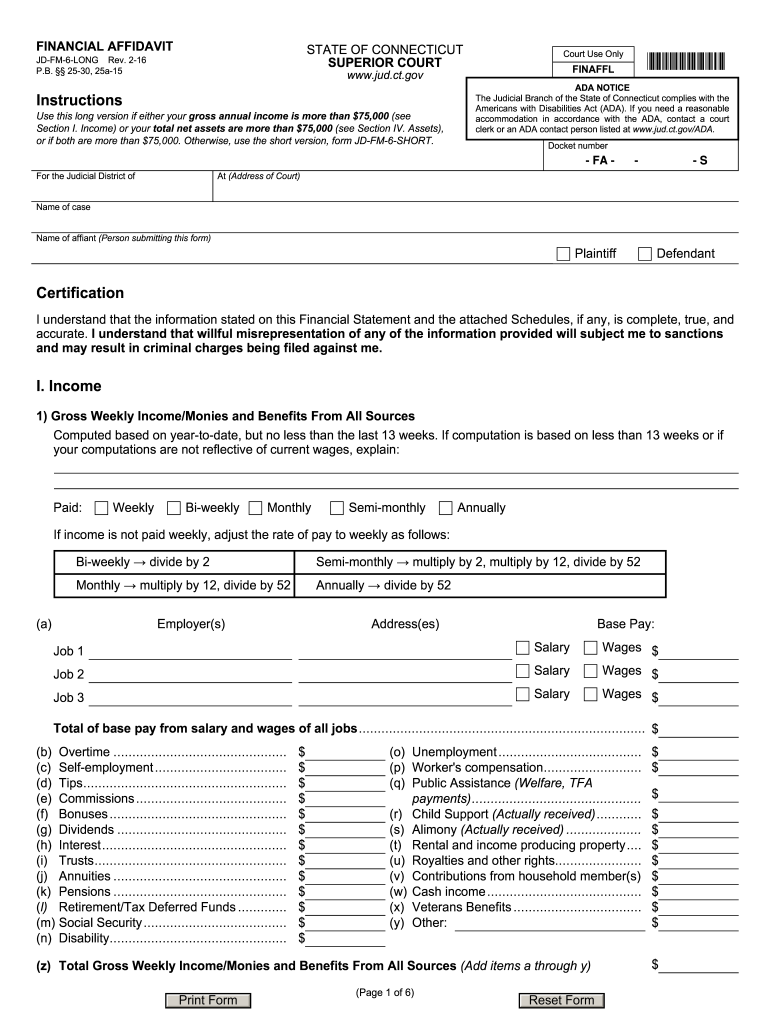

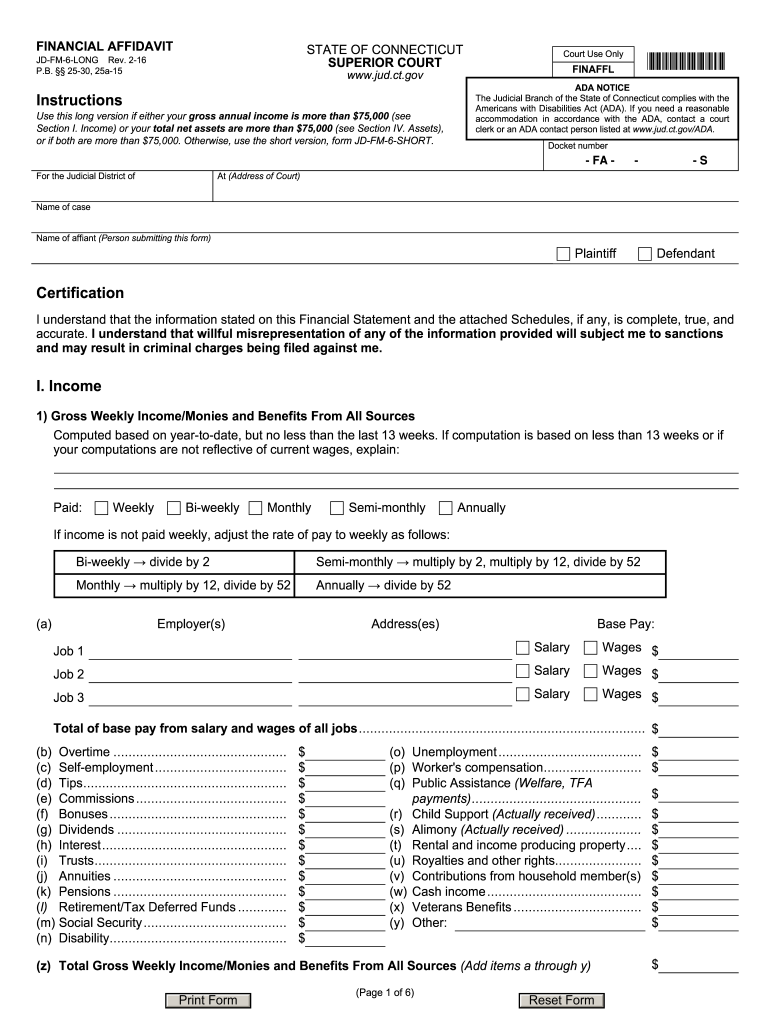

CT JD-FM-6-LONG 2016-2024 free printable template

Get, Create, Make and Sign

Editing financial affidavit long form ct fill online

How to fill out financial affidavit long form

How to fill out a financial affidavit state of:

Who needs a financial affidavit state of:

Video instructions and help with filling out and completing financial affidavit long form ct fill

Instructions and Help about ct child support financial affidavit form

One of the questions that we get a lot of times from our clients is how to complete the family law financial affidavit the family law financial affidavit is something that's going to be required in all cases involving a dissolution of marriage a paternity petition anytime there's child support involved equitable distribution of assets and debts so what I thought we would do is take a little of time just to explain the process and hopefully educate you on how to complete this form looking at the top of the form this is the caption you can find this information on any other document that you've already completed in your case in the circuit court of the blank here is obviously if you're in Hillsborough it's going to be a 13th Judicial Circuit it'd be different for Pinellas and Pasco and Polk and the same here and in for blank County you know here it would be Hillsborough, so you would just simply type in you know 13th if you're doing Hillsborough and then obviously Hillsborough goes here case number is whatever the case number is it was assigned to your file if it's a 2018 case you're gonna start with the 18 d r and then whatever the sequence of numbers are following that you know goes to 0 0 0 1 2 3 division is going to be for instance R or again whatever the division is that you've been assigned to petitioner pretty self-explanatory you just put the name of the petitioner there, and then you're going to put the name of the respondent down below again full legal name who's ever completing this the petitioner or the respondent date of birth what you do for a living you know whether you're a teacher doctor whatever it might be pilot and then down here under your currently if you're employed you're going to check this box and then you're simply going to put down your employer's name address and other contact information your pay rate is again either if you're paid every week whatever that might be if you're paid every other week which would be 26 times a year or if you're paid twice a month what again would be 24 times a year but whatever it is you put your pay rate there, and then you keep toggling down and since we're in 2018 last year's gross income you're going to put 2017 and then whatever it is that you made in 2017 from a gross income perspective and what the other party's income is moving forward your monthly gross salary or wages again looking back up here if it is your paid every other week that's 26 times you're going to multiply your pay rate times 26 times and then divide by 12 to get your monthly gross wages if you're paid twice a month you're going to take your pay rate multiply that times 24 and then divide by 12 to get your monthly gross wages when it comes to bonuses you know people might be paid quarterly they might be paid some other way whatever it is however you're paid if it's quarterly or whatever you're going to multiply that, and then you're going to divide by 12 to put down your monthly bonuses or commissions if it's some...

Fill jdfm6long financial download : Try Risk Free

People Also Ask about financial affidavit long form ct fill

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your financial affidavit long form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.